Preparation of lists of buildings for the purpose of valuation of property tax

The Act of 12th January 1991 on local taxes and fees among the objects subject to real estate tax points to buildings, determining the amount of tax at 2% of their value calculated on the basis of art. 4, paragraph 1, point 3 and paragraphs 3-7.

This Act defines the structures as construction objects in the meaning of construction law not being buildings or small architecture objects and also construction devices within the meaning of building regulations related to construction object, which provide the possibility of using the object in accordance with its the intended purpose.

Construction law giving the definitions of structures indicates each construction object other than a building or a small architecture object, such as: linear objects, airports, bridges, viaducts, overpasses, tunnels, culverts, technical networks, freestanding antenna masts, freestanding permanently connected with the ground advertising devices, earthworks, defensive – fortifications, protection structures, hydrotechnical structures, tanks, freestanding plant installations or technical devices, sewage treatment plants, landfills, water treatment plants, retaining structures, ground and underground pedestrian crossings, site utilities networks, sports facilities, cemeteries, monuments as well as construction parts of technical devices (boilers, industrial furnaces, wind turbines, nuclear power plants and other facilities) and foundations for machinery and equipment, as technically distinct parts of the objects that make up the entire utility) along with the installations and equipment as well as landscaping objects.

Construction devices are technical equipment related to the building structure, providing the possibility of using the object in accordance with its intended purpose.

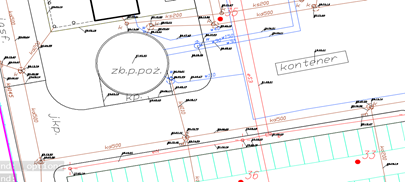

The valuation of structures for the purposes of real property tax is made by the appraiser on the basis of properly prepared list of structures drawn by surveyor on the basis of direct measurements. The list shall contain the necessary information for valuation. Due to different nature of the objects and hence different basis for the assessment of their values, these are different attributes. First of all, the list shall include: unique number of an object (also included in the map), the type of object, owner name, type of material, dimensions (length, width, height, diameter, surface area) or a description of the characteristics (number of supports, stairs, description of hatches). Each kind and type of the object should also be pictured for the purpose of unambiguous identification and correct valuation of the object.

Such drawn up list shall be consistent with the prepared map and directory of typical objects.